The 29th U.S. president only served a few years before his sudden death. During his brief time on the national scene, Warren G. Harding battled “Fighting Bob” La Follette for the soul of the Republican Party, gave us the Teapot Dome Scandal — one of the biggest political scandals prior to Watergate, and wrote some of the most impassioned and revealing letters ever penned by a president to a woman who was not his wife. Harding also gave us the word “normalcy.”

“Normalcy” was, in fact, coined as the theme of Harding’s 1920 campaign. A nation ground down by a recently ended World War I, a flu pandemic that killed more Americans — and more around the globe — than the war, a severe postwar recession, strikes and anarchist attacks, and Prohibition to boot, found “normalcy” a very appealing idea. Harding beat James Cox — who? — by the greatest margin seen in a presidential election since James Madison ran unopposed 100 years earlier.

Today, our time is also unsettled and the economy a little fragile although in much better shape overall than 1920. Nevertheless, “normalcy” today also has appeal. And I’m happy to report that many signs today point to a return of “normalcy.” Although it’s not in my venerable Webster’s Second Edition Unabridged, “normalcy” is a “a good word,” according to the man who invented it.

Normalcy in Wisconsin

“I really like Wisconsin … there's some sense of normalcy here — people having children, in homes they can somewhat afford to live in,” said Milwaukee native and NPR personality Michael Feldman.

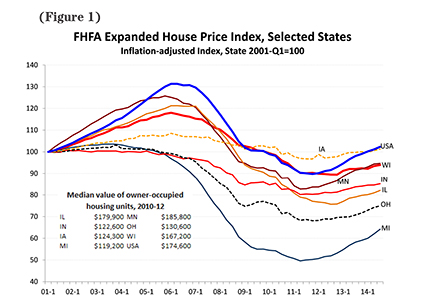

He’s right. Figure 1 shows the decade’s performance of state house price indexes from the Federal Housing Finance Agency (FHFA). Like most of the Midwest, Wisconsin did not “boom” as much as the average over all states; neither was the bust as severe. All in all, Wisconsin’s housing markets had problems but performed much better than most states.

Circa 2012, prices turned up in Wisconsin and most other markets. How fast are these prices expected to grow? Sustainable growth varies with market conditions; my rough calculation is that in a typical market, when real house prices grow more than half a percent beyond background inflation for a few years, it’s time to get concerned.

Because we’re in real estate, when thinking of the “market,” we naturally think of our own market and Figure 1. But housing and commercial real estate are intertwined with the rest of the economy. Let's look at the big picture.

A bumpy journey

“The world is on a bumpy journey to a new destination and the New Normal,” said Mohamed El-Erian, famous investor and chairman of the Global Development Council.

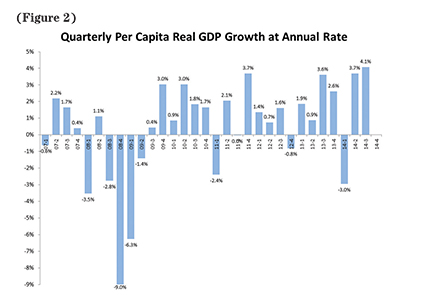

In 2014’s economic outlook, I noted that normalcy in real per capita GDP growth is about 2 percent per year and roughly 3 percent during an expansion. Growth during the post-Great Recession expansion, though, averaged an anemic 1.4 percent. This disappointing growth is below the overall long-run average that includes both recessions and expansions, and it’s only half the average rate for an expansion per se.

National income accounts mavens like myself still remain mystified by the first quarter 2014 decline of 3 percent. As Figure 2 shows, four of the last five quarters finally look like a “normal” recovery.

A “normal” labor market?

The health of real estate depends especially on increases in output (GDP) and how those increases translate into purchasing power. Here, the indicators are mixed. It’s well known that median family income (2 or more related individuals living together, $65,600 in 2013) and median household income (families plus more or less everyone else, $52,000 in 2013) have stagnated for 15 years, which is the first such long period of stagnation since the end of World War II. Other data show the first sharp post-war long-run decline in the share of GDP accruing to labor and a more skewed distribution. These shifts matter for housing and other real estate since our markets span rich and poor and everyone in between. The real estate industry needs, and can contribute to, a broad-based recovery.

As long as the labor market has slack, we may expect to see slow income growth. The slack is decreasing but is not fully wrung out yet:

- Unemployment is down below 6 percent.

- Long-term unemployment is falling but remains high.

- Labor force participation remains at the lowest rate in almost four decades.

Recent Bureau of Labor Statistics data show average hourly earnings increasing by 9 cents, which indicates a small upward earnings trend. But given the volatility in earnings and other compensation data, it’s far too soon to declare victory on the wages and income fronts.

Wisconsin’s economy is strongly connected to the neighboring states’ economies, the rest of the country, and for that matter, the rest of the world. But let’s drill down and compare Wisconsin’s recent performance with nearby states with data and incomes from the Bureau of Economic Analysis.

Boom, bust, benchmark

“To study the abnormal is the best way of understanding the normal,” said philosopher William James.

It’s been a while since Wisconsin has seen a truly “normal” year. While the housing market boomed in the early 2000s, most booms are followed by something else that starts with the letter “B”. How did Wisconsin’s economy perform during the boom between roughly 2001 and 2007? How about during the subsequent bust, and modest recovery during the post-boom years of 2007 to 2013? A modest recovery after a modest bust can leave us in a better place than a strong recovery after a serious collapse.

For a “normal” benchmark, take 1971-2001, the 30 years leading up to the boom and bust. Nationally, during that benchmark, U.S. employment grew by 2 percent per year, and real (inflation-adjusted) per capita incomes grew 2.3 percent annually; in Wisconsin, employment grew 1.9 percent, and real per capita incomes grew by 2.4 percent. Two factors drove national employment growth:

- Population growth, which averaged 1.1 percent per year.

- An increase in labor force participation, especially by women, which increased from 60 percent in 1970 to peak at 67 percent in 2000.

Interestingly, the slide in labor force participation so much remarked on during the bust actually started during the housing boom! Wisconsin’s 1971-2001 solid employment growth was exceptional because Wisconsin kept pace with the nation, even though population grew just 0.6 percent while the nation’s population grew at a rate of 1.1 percent.

While housing boomed between 2001 and 2007, the broader economy was already showing signs of weakness. U.S. employment growth rates slowed to 1.4 percent per year, and Wisconsin’s employment growth clocked in at 0.9 percent. Real per capita income growth slowed too, to 1.3 percent nationally and 0.9 percent in Wisconsin. While housing prices were taking off, the broader economy was already slowing down.

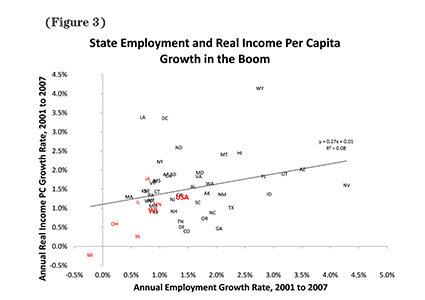

As Wisconsinites, we often compare ourselves to other Midwestern economies. Why stop there? As a Badger, I like to do well in the Big 10, but I also like to see where we stand in the national rankings. Figure 3 shows Wisconsin’s economy stacked up to the 50 states, Washington, D.C., and the national average, in income growth and in employment growth, during the 2001-2007 housing boom.

According to Figure 3, Wisconsin lagged the aggregate U.S. in both employment and income during the boom. Neighbors Indiana, Michigan and Ohio underperformed substantially; most of the states that outperformed the nation were in the West. There was not much of a link across states between income growth and employment growth during the boom.

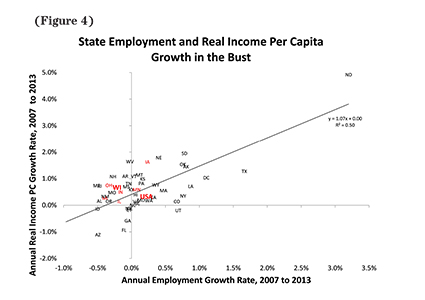

Figure 4 shows disappointing performance in incomes and employment growth during the Great Recession and its aftermath; Wisconsin wasn’t alone. Wisconsin lagged on employment even though it outperformed several Midwestern neighbors and the nation in income growth. Iowa and North Dakota are the exceptions, with strong growth fueled by the commodity and energy booms.

Moving forward

While many of us in real estate think of the early 2000s as a boom, the boom was only true for housing — not so for the broader economy. During the early 2000s, the economy was slowing, sowing a few of the many seeds of the Great Recession. While Wisconsin’s employment performance has been disappointing during the recovery, it was not as volatile as many of the neighboring states. And though there is room for improvement, Wisconsin’s income performance was not bad compared to many other states during and after the bust.

Wisconsin can do better than “not bad,” of course. Several years ago, I had the privilege of serving on a State Commission, chaired by Professor Donald Kettl, that articulated lessons from research and practice about fostering development. Some of those lessons still stand up well today, including the importance of education, infrastructure, governance and other essential ingredients for a healthy economy. Of course it’s hard to argue against the importance of education or infrastructure; the hard slog comes in formulating and executing actions that boost economic performance. I’m currently revising and updating some of those Kettl Commission lessons about what works and what doesn’t. I look forward to sharing more specifics in the future.

Economists Karl Case and Robert Shiller, among others, report that homebuyer confidence is up. As the economy strengthens and national policy starts to normalize, I expect interest rates to rise somewhat. While interest rates matter, other aspects in today’s world — such as financial markets and policies — matter as much or even more.

Furthermore, some signs suggest that capital flows to housing might start back toward normal this year. Although mortgage standards remain tight, the FHFA recently approved plans for Freddie Mac and Fannie Mae to re-introduce some lower down-payment products. The trick, of course, will be to underwrite these loans carefully so that the higher leverage offered doesn’t lead to higher defaults down the road.

Quantitative easing has ended — sort of. The Fed is no longer adding to its $4.5 trillion balance sheet in long-term treasuries and mortgage-backed securities. As the economy further strengthens, the next question is how the Fed plans to unwind these positions. Even though the markets could face some risk, I think they’ll manage. Still on the to-do list is figuring out how to sort out Fannie and Freddie and the rest of the housing finance system going forward.

More and more every year, I hear real estate professionals discuss risks that go beyond economics: Russia and the Middle East specifically. Slow growth in Europe and Japan, as well as slowing growth in China, have negatives for Wisconsin’s economy, although Wisconsin should benefit from falling energy prices.

Overall, I’m positive about 2015 prospects; I’m positive, but not giddy. Here are some of my 2015 expectations:

-

Inflation: I would like to see inflation — specifically the core personal consumption expenditure deflator, which is a better guide than the Consumer Price Index — pick up to a consistent 2 percent. But not much more than that! A bit more inflation will signal a strengthening economy and give a little “grease” to labor as well as real estate markets.

-

Home sales: I’ll be watching home sales to see if the number of first-time homebuyers starts to increase from less than a third of home sales to the 40 percent seen in more normal times.

-

Housing prices: In 2015, will housing prices find a happy medium, rising only in line with fundamentals, probably somewhere near their long-run historical growth rate of 30 or so basis points above inflation? A return to normalcy, devoutly to be wished!

-

Labor force participation: Will participation begin to edge back up, especially among younger workers, and will wages start to perk up?

Finally, at the always fascinating intersection between economics and politics, there are mixed messages. While both rhetoric and voting records indicate increasing polarization, the recent budget deal suggests that Washington is somehow finding ways to deal on some things that matter. Compromise and movement on issues like trade, immigration, infrastructure, and tax reform could give our economy a real boost.

The last word belongs to the originator of our word of the day: “America's present need is not heroics but healing; not nostrums but normalcy; not revolution but restoration,” said the 29th U.S. president Warren G. Harding.

Stephen Malpezzi is a Professor at the James A. Graaskamp Center for Real Estate at the Wisconsin School of Business.