We entered 2021 with significant hope and optimism. Following a very brief two-month recession, the economy had bounced back quickly, delivering the V-shaped recovery that many economists had predicted. Fueled by record-low mortgage rates and strong demand from millennials, the state housing market came roaring back in the second half of 2020 with total sales of existing homes setting a new record for annual sales. Finally, new COVID-19 vaccines had been developed, and the expectation was that once these were rolled out, the virus would be contained, effectively ending the pandemic.

However, as we close out 2021, the pace of economic growth has slowed as new variants of the virus have emerged to reduce consumer confidence. In addition, lingering labor shortages and supply chain problems have prevented more robust economic expansion. Moreover, significant inflationary pressures began to emerge in the spring, and they have intensified throughout the year. Nonetheless, even with consistently low housing inventories driving up home prices, sales remained strong. With 11 months of sales in the books, projections are that 2021 Wisconsin home sales will be very close to the record levels of 2020. In this article, we delve more deeply into the economic and housing trends that unfolded in 2021, and then consider the future path of both in 2022.

The economic recovery and the inflation problem

As recessions go, the 2020 recession was unique to say the least. It was the deepest contraction on record, but it was also far shorter than the typical recession. The U.S. economy entered the recession in March 2020, with Real Gross Domestic Product (GDP) contracting 5.1% in the first quarter of the year. As a result of the lockdowns, real GDP plunged 31.2% in the second quarter but then rebounded 33.8% in the third quarter as economic lockdowns were relaxed. After moderating to 4.5% in the fourth quarter of 2020, the economy grew at 6.3% and 6.7% in the first two quarters of 2021. However, the growth in the third quarter of 2021 was disappointing, with growth at just 2.1%, well below economists’ expectations.

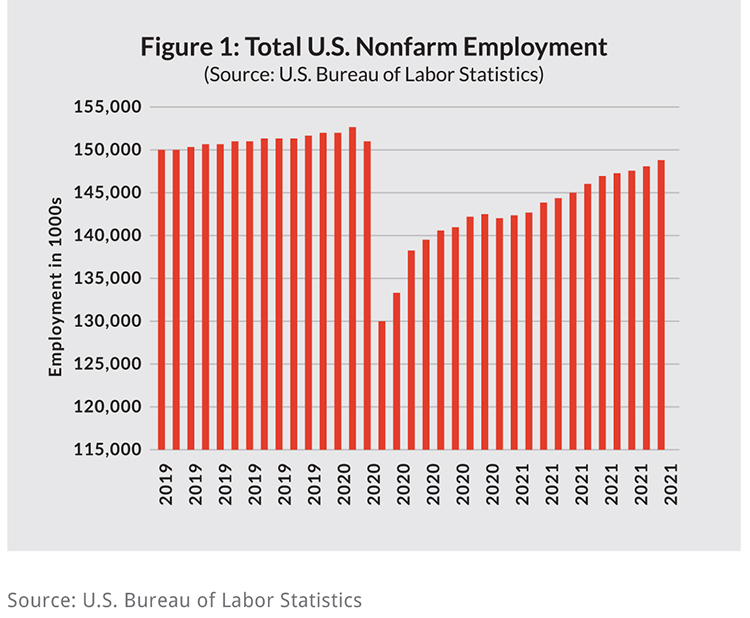

This most recent decline in economic growth can be attributed to a combination of factors. First, the pandemic introduced significant disruptions to the nation’s supply chain. As industries have become more global, so too has the supply chain system that supports those industries. As countries locked down their economies in an attempt to slow the spread of COVID-19, the free flow of trade was reduced. This disruption was a key factor in the slower growth in real GDP in the third quarter of 2021. A second factor was the ongoing labor shortages facing the U.S. Figure 1 shows that the U.S. total nonfarm employment plunged 14.7% between February and April of 2020, and while employment levels have improved, there are still 3.91 million fewer U.S. jobs than there were prior to the recession. Companies are struggling to find workers to fill vacancies, which drives up the cost of labor, fueling inflationary pressures and limiting economic growth.

2021 began with the annual inflation rate at just 1.4%. However, by April, inflation was running at 4.2%, and by November, it rose to 6.8%. This is the highest level seen in nearly 40 years. Energy and food prices are strong contributors to the overall inflation rate, but even removing those more volatile components of consumption to measure core inflation, that measure of inflation is still at a 30-year high. While Federal Reserve Chairman Jerome Powell initially indicated that inflationary pressures were expected to be “transitory,” the Fed has now signaled that it will likely begin raising short-term interest rates to control inflation. This is an indication that inflation is not as transitory as once believed. Keeping inflation in check is important since high inflation rates can threaten the economic recovery. Inflation erodes purchasing power when wages fail to keep up with inflation, and with nearly 70% of real GDP comprised of consumer spending, lower spending levels can reduce economic growth. Furthermore, when inflationary expectations rise, long-term interest rates such as 15- and 30-year mortgage rates also increase, which will influence the housing market.

The Wisconsin existing home market

Against this economic backdrop, the state housing market remained robust in 2021. To understand why, we consider both the demand and the supply factors at work.

Strong demand conditions

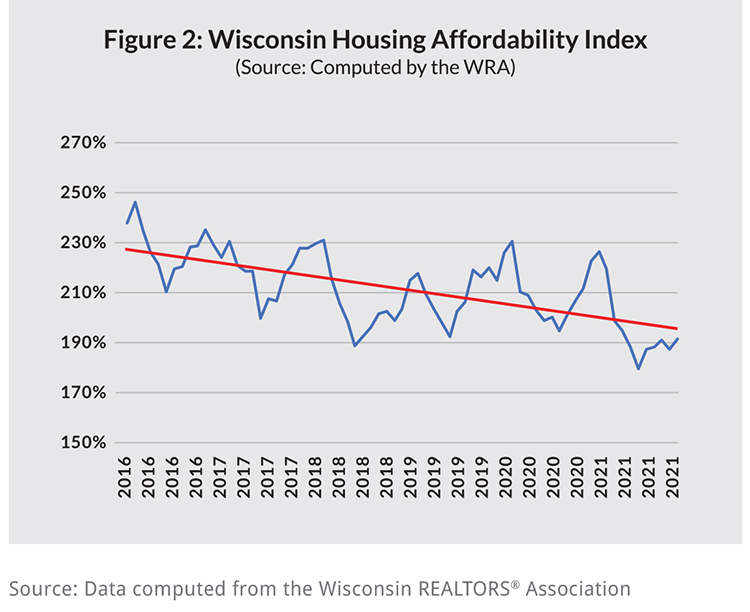

On the demand side, there are three main drivers of demand for housing: mortgage rates, the state labor market and demographic trends. Mortgage rates are near record-low levels. Bottoming out at 2.68% in December 2020, 30-year fixed-rate mortgages have inched up slightly in 2021 but have not exceeded 3.08%. These low rates have kept Wisconsin housing affordable even as home prices have risen steadily during 2021. The Wisconsin Housing Affordability Index is computed monthly, and it shows the percent of the median-priced home that a buyer earning the statewide median family income qualifies to purchase, assuming a 20% down payment and the remaining balance financed with a 30-year fixed mortgage at current rates. What is clear from the data plot in Figure 2 is that although affordability has been trending downward because of strong home price appreciation, the typical Wisconsin buyer can still afford to buy approximately 190% of the median-priced home in the state. For the purpose of comparison, the National Housing Affordability Index was at 148% in October, the most recent figure available from the National Association of REALTORS®. This is more than 40% lower than the comparable Wisconsin figure. Low mortgage rates have kept our housing affordable and fueled demand.

Turning to the state labor market, after the seasonally adjusted unemployment rate peaked at 14.8% in April 2020, it recovered quickly. By December 2020, the unemployment rate had fallen to 4% and continued to decline, dropping to just 3% by November 2021. Economists consider a 4% unemployment rate to be full employment, which means that the state has been at or above full employment since December 2020. In short, there are ample work opportunities for those seeking employment in the state, which helps fuel housing demand.

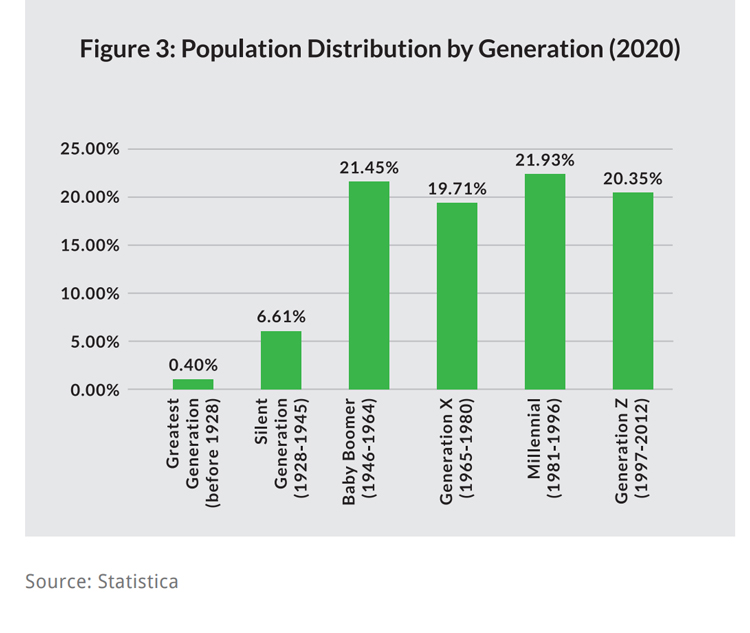

Finally, demographic trends are also stimulating demand for housing. As Figure 3 shows, the millennial generation, now aged 25 to 40 years, has surpassed the baby boomer population group as the largest in the U.S., with more than 72 million people classified as millennials in 2021. According to an analysis conducted by the Harvard University Joint Center for Housing Studies, the millennial generation is now the primary source of growth in households, and this will sustain demand as millennials continue to age through their 30s and early 40s.

Weak supply conditions

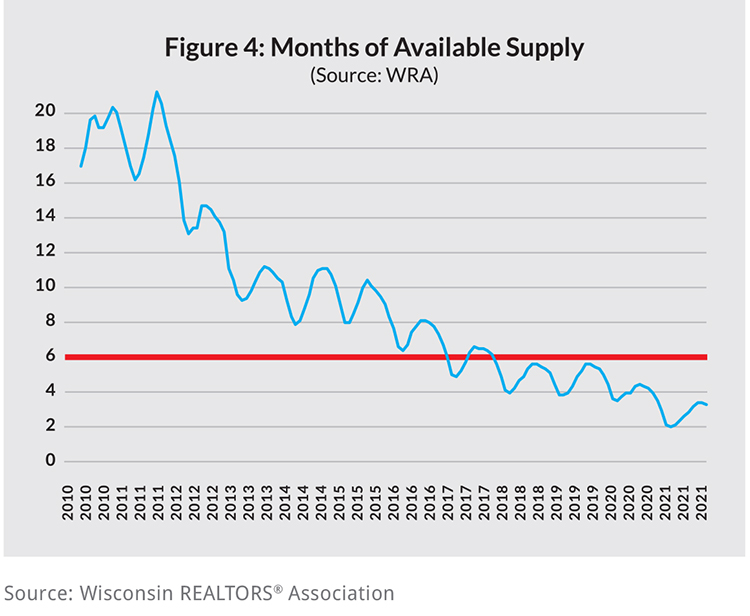

The challenge facing this market continues to be on the supply side. A market with approximately six months of supply is considered balanced, meaning that neither buyers nor sellers have an advantage. As Figure 4 shows, the Wisconsin housing market has seen shrinking supply since 2011, and the market has been classified as a seller’s market since the latter half of 2016. Although there has been solid growth in new construction of single-family homes as measured by permit activity, overall inventories have continued to fall statewide.

Strong year for sales as prices continue to rise

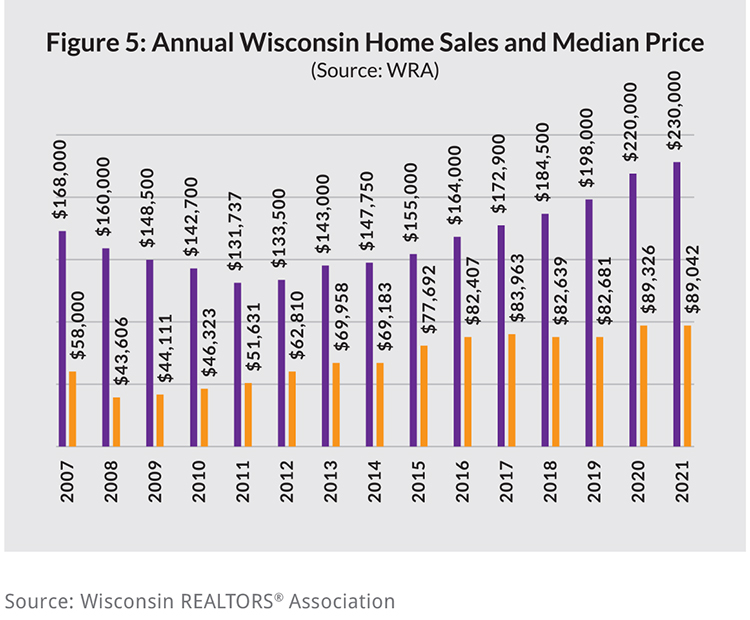

Given the very strong demand conditions, REALTORS® have continued to sell homes at a very healthy clip. Figure 5 shows annual sales going back to 2007, and it extrapolates 2021 sales assuming that the pace established in the second half of 2021 will continue into December. Under those assumptions, home sales will be close to but fall just short of the record sales established in 2020. The limited supply is the primary reason that sales are not surpassing 2020 sales. However, the combination of strong demand and weak supply are a recipe for rising prices, and hence the patterns of price appreciation seen in Figure 5. Again, the 2021 prediction is an extrapolation that assumes prices will continue to grow in December at the pace established between July and November of 2021.

Predictions for 2022

Unlike previous years, we enter 2022 with considerable uncertainty as to the direction of the economy. Much of this uncertainty is linked to how the latest variants of COVID-19 behave. The Fed has a dual mandate: to keep the economy at full employment and to maintain stable prices. It has a strong record of achieving both of these goals, however there are times when these goals come into conflict. Consider the classic example of the early 1980s, when then Fed Chairman Paul Volker used tight monetary policy to finally tame inflation even though those actions led to a double-dip recession. Chairman Powell has signaled an intention to begin raising short-term interest rates, and this is a prudent strategy to keep inflation from intensifying. While it may further slow economic growth, the Philadelphia Federal Reserve Bank’s Survey of Professional Forecasters is still predicting economic growth throughout 2022, with moderate inflationary risks.

With these economic predictions, we conclude that the state housing market will likely moderate on the demand side primarily because mortgage rates are expected to increase in 2022. This would be true even if the recent spike in inflation proves to be transitory since the Fed has already indicated its intention to raise short-term interest rates in 2022. In addition, a moderation in economic growth will also release some of the demand pressure. However, countering that will be the continuation in household growth driven by the millennial generation. Thus, at most, demand pressures will moderate slightly. On the supply side, one thing that baby boomers cannot outrun is the passage of time. With the oldest boomers now 75 years of age, those who currently live in single-family detached homes will progressively be forced to consider alternatives. This will increase the supply of existing homes on the market. Demographic trends are, by definition, slow to evolve, so the overall prediction is for a slight reduction in demand, and a slight increase in supply. The overall impact on sales is likely to be minor, but the impact on price appreciation should be more noticeable. There will still be price appreciation, but it will likely remain in the single digits, like the most recent four months where home prices appreciated between 6.4% and 7.6% on an annual basis. To summarize, we expect the Wisconsin housing market to remain a seller’s market in 2022, just slightly more balanced than in 2021. This should lead to solid sales, but slightly lower price pressure in 2022.

David Clark, Ph.D., is a professor of economics at Marquette University and principal at ECON Analytics, LLC, and serves as a consultant to the WRA in the analysis of home sales data as well as in the preparation of the monthly Wisconsin Housing Report. For more information, contact Clark at 414-803-6537.