Wisconsin had two straight record years for home sales in 2020 and 2021. The record sales were fueled on the demand side by very low mortgage rates, a strong labor market and significant household formation by the millennial generation. However, the supply

side of the housing market remained tight, which resulted in significant housing price pressure, including double-digit appreciation in 2020 and 2021. Unfortunately, a serious inflation problem began to emerge in spring 2021 and intensified in 2022,

peaking in June. While there has been slight moderation in inflation since that time, inflation has remained stubbornly high, which led the Federal Reserve Bank to take decisive action. The combination of higher home prices and higher mortgage rates

has caused affordability to plummet, thus softening housing demand. As we recently concluded 2022 and begin 2023, sales are well off the pace of 2021, and tight supplies continue to push home prices up. In this article, we provide an overview of current

and expected future macroeconomic conditions and discuss the likely impact of policy actions on the economy. We then evaluate the Wisconsin housing market from both demand and supply perspectives, and discuss expected trends for 2023.

Macroeconomic growth and persistent inflation in 2022

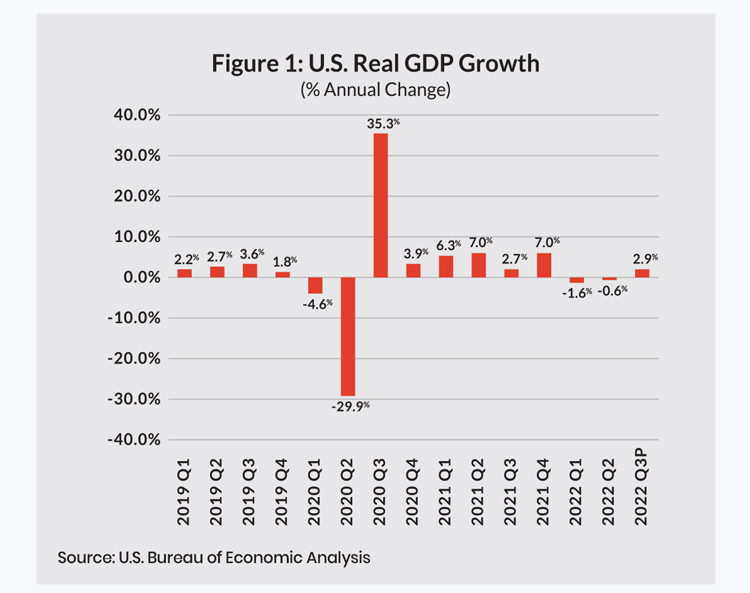

The U.S. economy grew at a robust pace in 2021. Specifically, the real GDP, which is inflation-adjusted GDP, grew at 5.9% for the year, and as shown in Figure 1, all but the third quarter of 2021 saw annual growth rates at or above 6.3%. The national

unemployment rate fell throughout 2021, ending the year with a December unemployment rate of 3.9%. This is indicative of an economy operating at full employment. Although the economy had not yet recovered all the nearly 22 million nonfarm jobs that

it lost during the pandemic-induced recession in March and April of 2020, the economy continued to add jobs and was within 3 million of the pre-recession peak by the end of 2021.

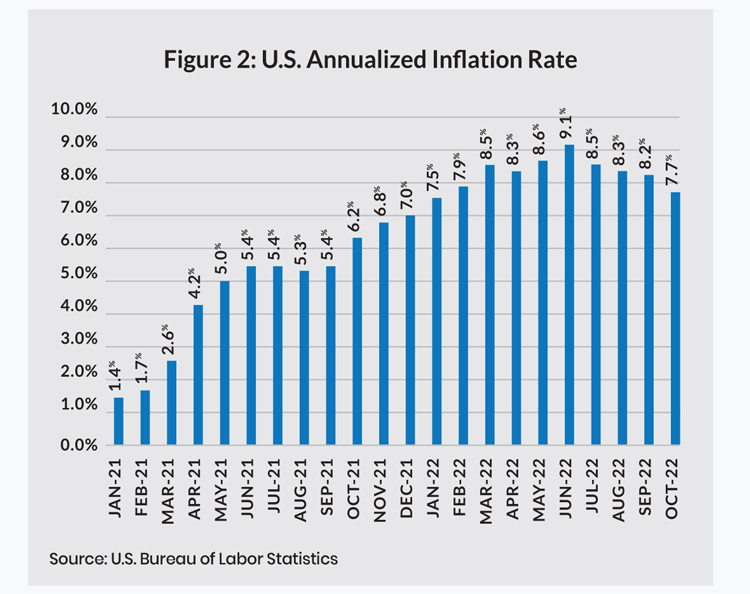

However, there were some troubling signs that the spike in inflation that emerged in spring 2021, and was initially thought to be a transitory problem, was actually far more persistent. As seen in Figure 2, headline inflation, which is the annualized

percent change in the Consumer Price Index, started 2021 at just 1.4%, and by the end of the year, it had increased to 7%.

In hindsight, the combination of ongoing supply chain issues, rising energy prices and a very tight labor market created supply shocks that drove up the general price level. However, on top of that, policy decisions also created strong demand pressure

on the economy, which further exacerbated the inflation problem. Specifically, unprecedented levels of deficit spending and an expansionary monetary policy stimulated an economy that was already at full employment. The huge stimulus spending led to

over $3 trillion in deficit spending in fiscal year 2020 alone, and this was followed by additional spending of $2.8 trillion in 2021 and just under $1.4 trillion in 2022.

An expansionary monetary policy also contributed to the inflation

problem. Indeed, a Nobel Prize-winning monetary economist by the name of Milton Friedman famously stated in the early 1960s that “inflation is always and everywhere a monetary phenomenon.” While the economic theory behind this statement is somewhat

complex, there is no doubt that the rapid increase in the supply of money in the economy — for example, the M2 measure of the money supply increased by 24.2% in 2020 alone — also added to the inflationary pressures.

Fed actions to lower inflation

The Federal Reserve Bank has a dual mandate to maximize employment while maintaining price stability. In early 2022, with the economy essentially at full employment, the Fed signaled that it would aggressively raise the short-term Federal Funds Rate.

This is the overnight rate at which member banks lend to each other to cover reserve shortages, and raising this rate has the effect of slowing the economy. In doing so, the increase hopefully reduces inflationary pressures. Between mid-March 2022

and early November 2022, the upper limit of the Federal Funds Target Range was increased from 0.25% to 4%, although real GDP did go into slight negative territory in the first half of 2022, as shown in Figure 1. This raised concerns that the economy

was slipping into recession. However, the strong labor market with low unemployment and solid job growth likely prevented the National Bureau of Economic Research from drawing that conclusion in this case. The preliminary 2022 Q3 estimates of real

GDP growth showed a solid 2.9% growth rate. As a result of these actions by the Fed, we have seen modest progress on inflation. Specifically, headline inflation peaked in June 2022 at 9.1%; and by October 2022, it had fallen to 7.7%. It should be

noted that the Fed’s target rate for inflation is 2%, and the Fed has indicated that it will continue to raise the Federal Funds Rate so long as inflation remains elevated, even if that decision leads to a more sustained economic slowdown.

The Wisconsin existing home market

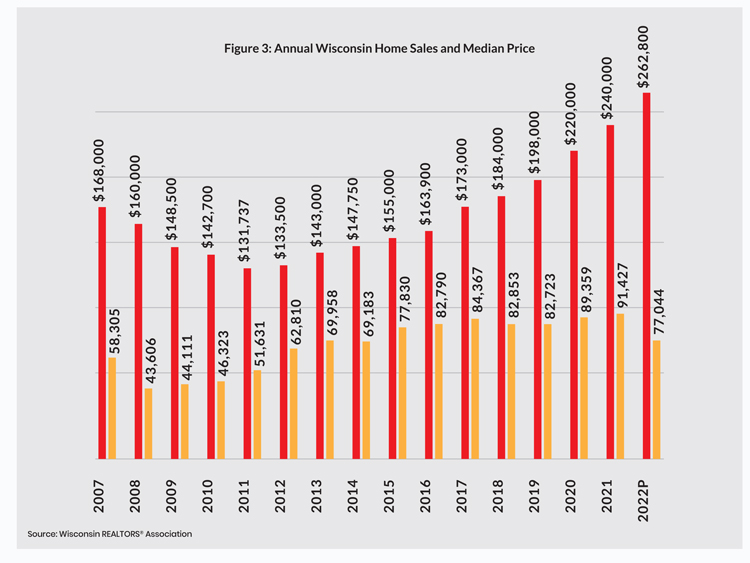

Against this economic backdrop, Figure 3 shows how existing home sales slowed significantly in 2022 compared to 2021, even as home prices continue to rise. As this article went to press, the final housing activity for December had yet to be recorded.

However, if current trends continue through the last two months of the year, we project 2022 existing home sales to fall by nearly 16% when compared to the record sales of 2021; and median prices are expected to rise by 9.5% over that same period.

We briefly explore both the demand and supply drivers to explain market trends in 2022 and then project those trends into 2023.

Declining affordability weakens demand

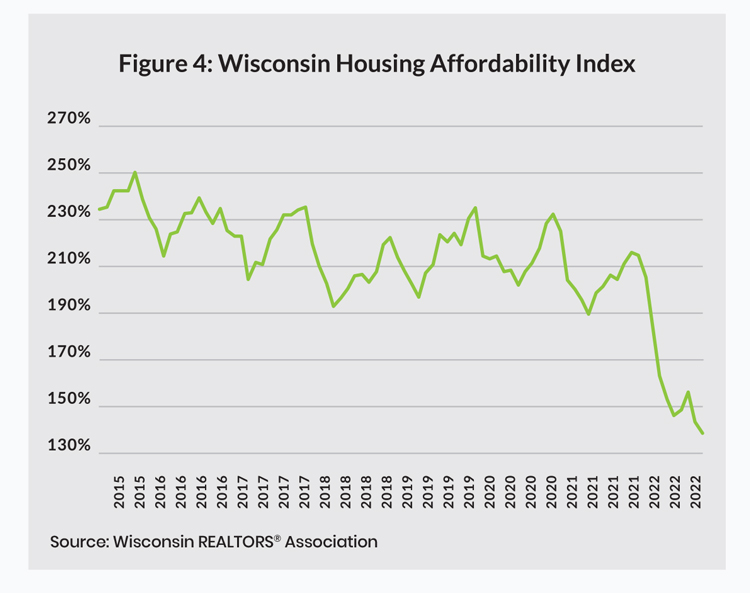

On the demand side, a dramatic slide in housing affordability was the primary reason demand weakened. The WRA Housing Affordability Index shows the fraction of the median-priced home that a buyer with median family income qualifies to buy, assuming a

20% down payment and the remaining balance financed with a 30-year fixed-rate mortgage at the rates available at the point of purchase. Affordability depends on three statewide factors:

- Growth in median family income

- Growth in the median price of homes

- Growth in the 30-year fixed mortgage rate

Wisconsin added more than 100,000 nonfarm jobs between October 2021 and October 2022. This solid job growth pushed the median family income up by just over 6.2% for that 12-month period. Were home prices and mortgage rates to have remained unchanged over

that same period, the growth in income would have increased affordability. Unfortunately, both the median price and mortgage rates also rose. Specifically, the median price increased 6.1% between October 2021 and October 2022, whereas the 30-year

fixed-rate mortgage more than doubled from 3.07% in October 2021 to 6.9% in October 2022. As seen in Figure 4, this caused the Wisconsin Housing Affordability Index to drop 32.1% in the 12 months ending in October 2022.

Ongoing supply side weakness

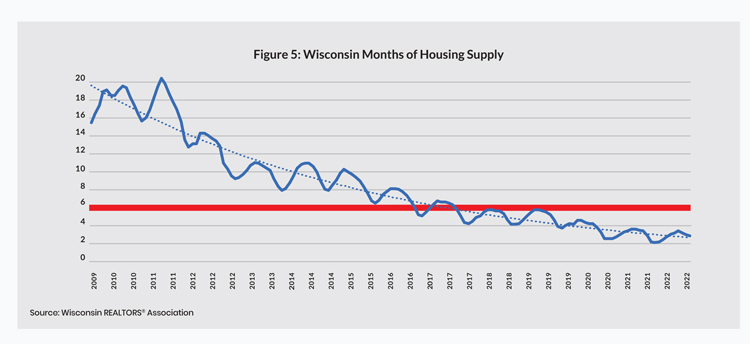

A balanced housing market has approximately six months of available supply. Markets with more than six months of supply are considered buyer’s markets, whereas those below the six-month benchmark for inventory are classified as seller’s markets. Inventory

data does follow a regular seasonal pattern with more available supply during the slower winter months for sales and weaker supply during peak sales periods. However, what is clear from Figure 5 is there has been a nonlinear downward trend in supply

since the economy emerged from the Great Recession, and the Wisconsin housing market has seen a strengthening of the seller advantage since fall 2017. By October 2022, there was just 2.6 months of housing supply statewide.

The combination

of softening demand and very weak supply has led to the substantial reduction in predicted home sales in 2022, which is the projected annual totals after the first 10 months of actual sales for 2022. In addition, median prices continue to rise, but

weakening demand has begun to moderate the annual growth in prices. The median price for October rose just 6.1% over that same month in 2021. This compares to an annualized growth in the median price of 10% for the first nine months of 2022 compared

to that same period in 2021.

Predictions for 2023

The Fed is fully committed to reigning in inflation to keep it from getting embedded in the economy, and while the rate of inflation fell from 9.1% in June 2022 to 7.7% in October, the rate remains well above the Fed’s target rate of 2%. For 2023, we

expect the upper limit of the Federal Funds Target Range to continue to increase, and it’s likely to rise into the 5.5% and 6.0% range. As a result, by Q4 of 2023, we expect inflation to fall and be no higher than 6%, and we anticipate the 30-year

fixed-rate

mortgage to fall below 6% by that time.

The risk of recession will grow as the Fed continues to push short-run interest rates upward to mitigate inflation, and we believe there are even odds of a recession in 2023. There are

concerns that the job growth seen in 2022 cannot be sustained in 2023. Even if the economy remains in an expansionary mode, real GDP growth will likely be tepid, growing at or below 2% for each of the quarters of 2023. Moreover, the housing market

will not likely rebound significantly from its 2022 performance. By Q4 of 2023, we expect year-to-date home sales to be within plus or minus 5% of 2022 levels and year-to-date median prices to be no more than 6% higher than 2022 prices. Finally, housing

inventory levels will improve slightly in 2023, but the market will remain a seller’s market throughout the year.

David Clark, Ph.D., is a professor of economics at Marquette University and principal at ECON Analytics LLC, and serves as a consultant to the WRA in the analysis of home sales data as well as in the preparation of the monthly Wisconsin housing report. For more information, contact Clark at 414-803-6537.