Working with commission splits involves several key elements. Splits are addressed in the listing contract, in the MLS, in policy letters and in compensation agreements, and unfortunately, in broker conversations about commissions and commission splits. Clearly there are proper ways to establish and communicate commission splits and to modify them, and there are some inappropriate, risky behaviors that should be eliminated.

General background

The birthplace of most commission splits offered to cooperating brokers in the MLS and in other compensation agreements is the listing contract. To be absolutely clear, local boards and associations of REALTORS® and their MLSs never fix, control, recommend or suggest the commissions or fees charged for real estate brokerage services or the cooperative compensation offered by listing brokers to potential cooperating brokers. Commissions and commission splits are negotiated and established between the listing firm and the seller client in the listing contract.

Listing contracts

The listing contract determines the compensation paid by the seller to the listing firm. At the time of the listing, the listing firm should discuss commission with the seller, including what the listing firm will offer as cooperative commission, for example, in the MLS.

The listing contract includes the following provision:

COMPENSATION TO OTHERS: Broker offers the following commission to cooperating brokers: _____________________________________ (Exceptions if any): ________________.

This provision is consistent with Standard of Practice 1-12 of the REALTOR® Code of Ethics that provides when entering into listing contracts, REALTORS® must advise sellers about the firm’s policies regarding cooperation with other brokers and the rate or amount of compensation that will be offered to subagents and buyer’s agents. Prudent listing brokers disclose their MLS compensation splits, if they have policy letter compensation agreements with any brokers, and let the seller see copies of policy letters upon request.

MLS

In listing property with the MLS, participants make blanket unilateral offers of cooperation to the other MLS participants and specify the compensation being offered to the other MLS participants. Cooperating participants have the right to know what their compensation will be prior to commencing their efforts to sell. The listing firm determines the amount of compensation offered to subagents, buyer’s agents, or to brokers acting in other agency or nonagency capacities, which may be the same or different. The compensation offered on MLS listings is expressed as a percentage of the gross sales price or as a definite dollar amount.

Compensation agreements

Commission agreements with brokers outside of the listing firm’s MLS may take the form of a bilateral compensation agreement. Unless the firms have a standing policy letter agreement or a compensation agreement for that transaction, the listing firm has no obligation to pay the cooperating firm.

A compensation agreement, preferably in writing, should describe the property, name the parties and the firms, identify the agency relationship, confirm the offer and acceptance of cooperation, state the commission or fee in clear and specific terms, indicate when the compensation shall be paid, and state what must be done to earn compensation. The WRA Compensation Agreement in zipForm is structured to be used as a compensation agreement between two firms with regard to a particular property and transaction identified in the agreement.

Offering different co-broke splits to different groups of firms

Firms may make different offers of compensation to licensees within and outside of the firm’s MLS. For instance, the listing firm may determine some cooperating MLS firms should receive one commission rate while others should receive a different rate. In any instance where a listing firm is offering different rates or amounts of commission to different groups of cooperating firms, that needs to have first been discussed with the seller and authorized in the listing contract.

MLS remarks are not binding

Brokers may believe they can put in MLS remarks that cooperating firms that are not members of certain associations or MLSs will receive a different commission split than what was offered in the MLS. For example, the listing firm puts 2% in the field for commissions, and in private remarks states: “2.4% co-broke commission to XYZ MLS participants only, 2% co-broke commission to ABC Association and all other participants.”

Even though the information in the MLS private remarks area provides notice to those who read it, there is no guarantee it reaches each broker in the intended group. There is no requirement to read private remarks. Notes in the remarks section of the MLS are not binding upon other MLS participants.

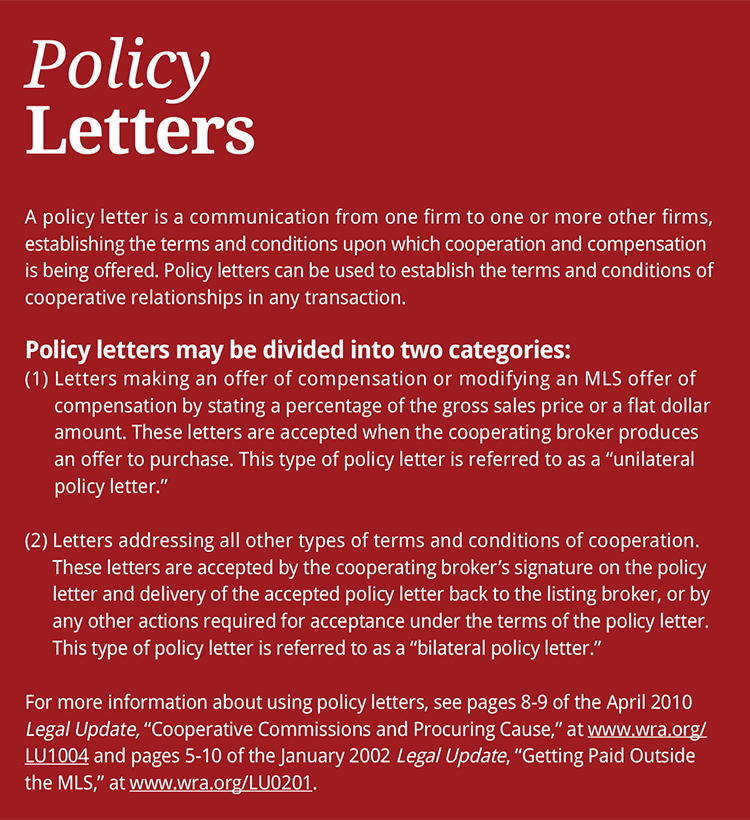

Policy letters

The listing firm may offer any MLS participant compensation other than the compensation offered in the MLS listing, provided the listing firm informs the other firm in writing in advance of their submitting an offer to purchase. In addition, the commission modification cannot be the result of any agreement among all or any other participants of the MLS. Any superseding offer of compensation must be expressed as either a percentage of the gross sales price or as a flat dollar amount unless there is a bilateral agreement agreed to by both brokers.

Once the offer to purchase has been submitted, the listing firm may no longer change the offer of compensation shown in the MLS. Standard of Practice 3-2 to Article 3 of the REALTOR® Code of Ethics states:

Any change in compensation offered for cooperative services must be communicated to the other REALTOR® prior to the time that REALTOR® submits an offer to purchase/lease the property. After a REALTOR® has submitted an offer to purchase or lease property, the listing broker may not attempt to unilaterally modify the offered compensation with respect to that cooperative transaction (Amended 1/14).

If properly authorized in the listing contract, a listing firm may wish to offer a lower rate or amount in the MLS and then send unilateral policy letters to those who will be offered more. Whatever is offered in the MLS sets the expectation for everyone, and it may be psychologically more effective to start with the lower amount and offer more to the specific group.

The MLS does not have a method by which a listing firm may unilaterally qualify or condition the MLS offer of compensation. If something other than percentage of gross sales price or dollar amount were contemplated, an agreement would have to be entered into between the firms; for example, a bilateral standing policy letter or a compensation agreement for the individual transaction.

As always, the firm should check the local MLS rules to see what the local policy provides; those rules may be different than the NAR model rules.

Talking about commission splits

If some of the licensees who include notations in MLS remarks regarding cooperating commission modifications have been having conversations about commission splits, who offers what, and what the “usual” or “normal” or typical” commission splits are with different companies or in different market areas, they should be careful because they are running the risk of violating antitrust law.

An illegal price fixing conspiracy can involve not only the commissions a firm charges clients but also the commission splits paid to cooperating firms that bring buyers for listed properties. A form of price fixing may occur if competing firms discuss and agree how commissions should be split with other firms.

Antitrust concerns

Antitrust laws were enacted to prevent competitors from participating in business practices that restrain trade. When competitors work together in a manner that restrains trade, there is a potential for antitrust violations. Three basic elements must be proved to establish a violation of Section 1 of

the Sherman Act. There must be (1) a “contract, combination,

or conspiracy” involving two or more separate business entities that (2) unreasonably restrains trade and (3) is in or affecting interstate commerce.

A “contract, combination, or conspiracy” exists whenever two separate economic entities, such as two real estate companies, act according to a joint agreement or scheme. A formal contract and even words are not required — a knowing wink may be all that is necessary. Circumstantial evidence of an antitrust conspiracy often includes proof that two or more competitors act in a “consciously parallel manner.” “Consciously parallel” behavior is when two or more competitors act in a similar way with full knowledge of each other’s actions. But a conspiracy does not occur if an action has been taken independently by each entity as a result of internal decision-making.

REALTORS® must always avoid all communications and discussions with other firms that relate in any way to the commission rates or cooperative commissions. To protect against price fixing charges, all decisions concerning commissions must be independent business decisions made solely within the firm’s office that are carefully documented. Firms should be sure that their sales agents and other staff are trained to explain the commissions and fees charged by the company in terms of independent decisions and competitive market forces and to avoid giving the appearance

of a conspiracy among competing companies.

Resources

- Antitrust law: March 2004 Legal Update, “Antitrust Primer for Real Estate Practice,” at www.wra.org/LU0403.

- Compensation agreements: November 2018 Legal Update, “Compensation and Referral Agreements,” at www.wra.org/LU1811, and pages 10-11 of the January 2002 Legal Update, “Getting Paid Outside of the MLS,” at www.wra.org/LU0201.

- November 2007 Broker Supervision Newsletter, “Antitrust Law and Cooperative Commissions,” at www.wra.org/BSNNov07.

Debbi Conrad is Senior Attorney and Director of Legal Affairs for the WRA.