As part of the 2019-21 state budget, Gov. Tony Evers proposed allowing local governments and technical colleges to increase local property tax levies by a minimum of 2 percent each year. In doing so, Gov. Evers has indicated that local governments and technical colleges need more revenue to keep up with rising costs due to inflation. Under this proposal, the property taxes for the average homeowner, based on $170,000 median home, would increase approximately $70 per year.

The WRA opposes the proposed property tax increase, which would make housing less affordable and increase the costs of doing business in Wisconsin. While a 2 percent annual increase in property taxes may seem reasonable, Wisconsin property taxpayers already pay more than their fair share of local government and technical college expenses, and it is time to designate revenue from other sources to provide additional revenue to these essential services.

Background

Property taxes affect the affordability of homes and the profitability of businesses. High property taxes create a barrier to homeownership and job growth in Wisconsin.

Since 2011, Wisconsin has successfully controlled property tax increases by placing strict levy limits on municipalities and counties. During this time, the property tax freeze has saved Wisconsin families and businesses $3.5 billion. In fact, the owner of a median-valued home paid $88 less in property taxes in 2018 than in 2010, according to the Wisconsin Legislative Fiscal Bureau.

However, even after these measures, property taxes in Wisconsin remain too high. Consider the following:

-

The property tax is Wisconsin’s highest tax: In 2018, Wisconsin homeowners and businesses paid approximately $11.02 billion in property taxes, compared to $8.48 billion in income taxes and $5.45 billion in sales taxes.

-

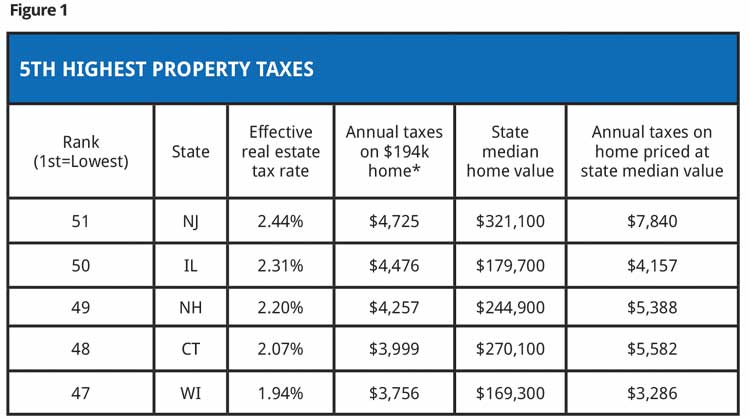

Wisconsin property owners pay among the highest property taxes in the country: In 2018, Wisconsin’s property tax rate was the fifth highest in the country according to thebalance.com. See Figure 1.

-

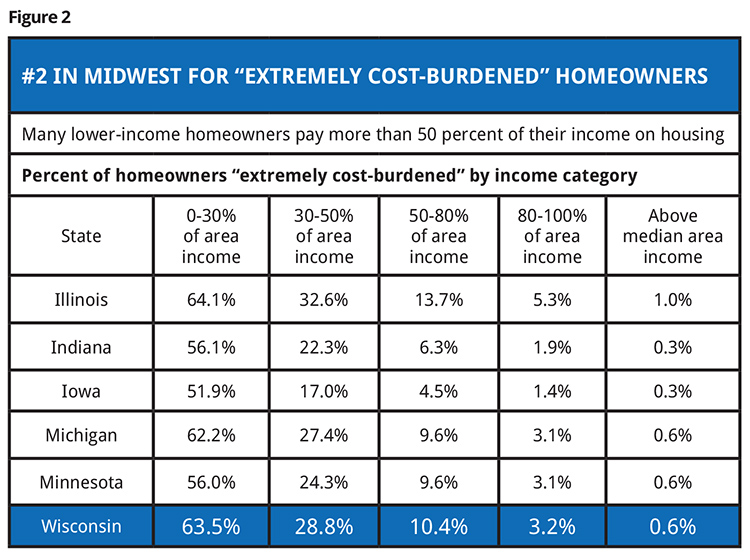

Wisconsin homeowners are having difficulty affording their homes: Among Midwestern states, Wisconsin has the second-highest percentage of homeowners across all income levels who are “extremely cost-burdened” paying more than 50 percent of their income for housing. Only Illinois ranks higher. See Figure 2.

Property tax proposal concerns

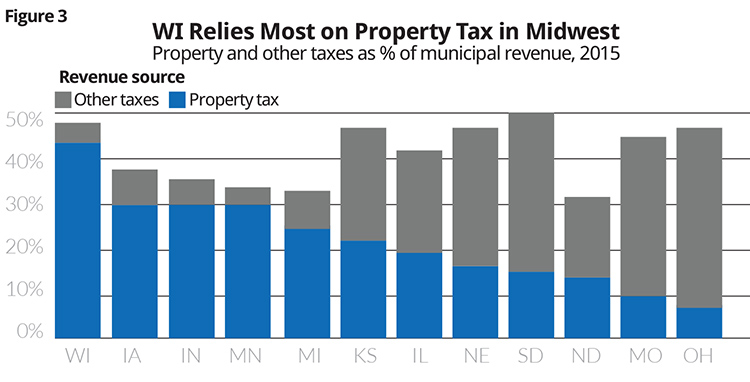

Wisconsin relies too heavily on property taxes to fund local governments: According to a recent study by the Wisconsin Policy Forum, Wisconsin is over-reliant on property taxes to fund local governments. Wisconsin ranks seventh nationally and first in the Midwest among states for being the most reliant on the property tax for their revenues. Other states fund these essential services through a more balanced mix of other taxes and fees. See Figure 3.

Increasing property taxes will make it more difficult to attract workers to Wisconsin: With statewide housing inventory levels at historic lows, median home prices continuing to rise, and apartment rent increases outpacing wage growth, Wisconsin has a workforce housing shortage problem. The lack of affordable housing options has made it more difficult for employers to recruit workers to Wisconsin. Loosening levy limits to allow greater property tax increases will only make this problem worse.

Current levy limits allow taxpayers to raise their own property taxes: Under the current levy limits, local taxpayers may raise their own property taxes through local referenda when they think the money will be used wisely. In fact, the vast majority of local referenda pass. Consider the following:

School districts: Since 1990, Wisconsin school districts have passed more than 1,600 referenda, totaling $12 billion. In November 2018, voters approved 77 of the 82 school district referenda on the ballot, choosing to raise their property taxes by approximately $1.4 billion, which is approximately a 94 percent approval rate. These local referenda asked voters to borrow money for capital projects, exceed their state-mandated revenue limits or expand programming.

Local governments: In 2018, approximately 15 communities across the state held referenda to exceed state-imposed property tax levy limits, and voters in 11 of those communities gave their approval, which was approximately a 73.3 percent approval rate. These local referenda asked voters to exceed the limits for public safety, roads, an aquatic center and county health care facilities.

While adequate funding for schools and local services is important, placing a greater burden on property taxpayers is not the answer: As REALTORS®, we know the importance of good schools and strong local communities to homeowners and a successful real estate market. However, property taxpayers in Wisconsin already pay more than their fair share. Rather than raising property taxes, Wisconsin must find a different way to fund local governments and schools.

The WRA will be working with the Evers administration and legislators on both sides of the aisle to provide both short-term and long-term property tax relief by maintaining the current levy limits and providing new ways in the future to fund local governments, schools and technical colleges.

Tom Larson is the Senior Vice President of Legal and Public Affairs for the WRA.

Source for annual taxes on $194k home: thebalance.com

Source: U.S. Department of Housing and Urban Development, Comprehensive Housing Affordability Strategy Data, 2011-2015

Sources: U.S. Census Bureau, Willamette University