Wisconsin lawmakers are currently considering a proposal, referred to as “Move Forward Milwaukee,” that would allow Milwaukee County to increase sales taxes to generate more revenue to pay for the rising costs of local services and improvements. To make the proposed sales tax increase more attractive to both state lawmakers and Milwaukee County residents, the proposal requires that a portion of the increased revenue be used to buy-down property taxes for homeowners. The proposal applies only to Milwaukee County but could be expanded statewide by future lawmakers if they believe the proposal is a better way to fund local government services than our current system.

Background

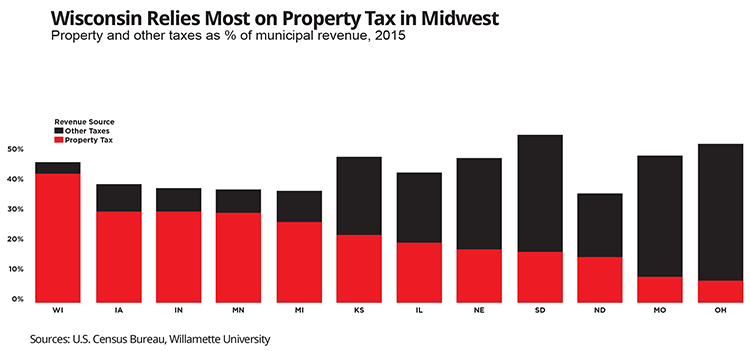

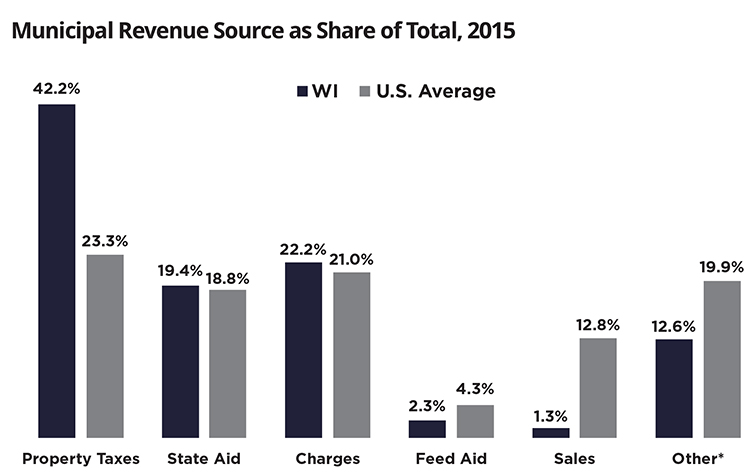

Wisconsin municipalities rely heavily on property taxes to fund local government services. According to research by the Wisconsin Policy Forum, Wisconsin ranks seventh in the nation and first in the Midwest for its reliance on property taxes for funding municipalities. Other states utilize a broader revenue mix to fund local services including sales taxes, income taxes and other specialty taxes and fees, such as wheel tax, parking or solid waste management.

In comparison, sales taxes in Wisconsin are among the lowest in the country. According to the Tax Foundation, Wisconsin is 43rd on the list of states ranked from highest to lowest sales tax, and four of the states do not have a state or local sales tax, which are Delaware, Montana, New Hampshire and Oregon. On average, Wisconsin municipalities receive 1.3 percent of their revenues from sales taxes, while the national average is 12.8 percent.

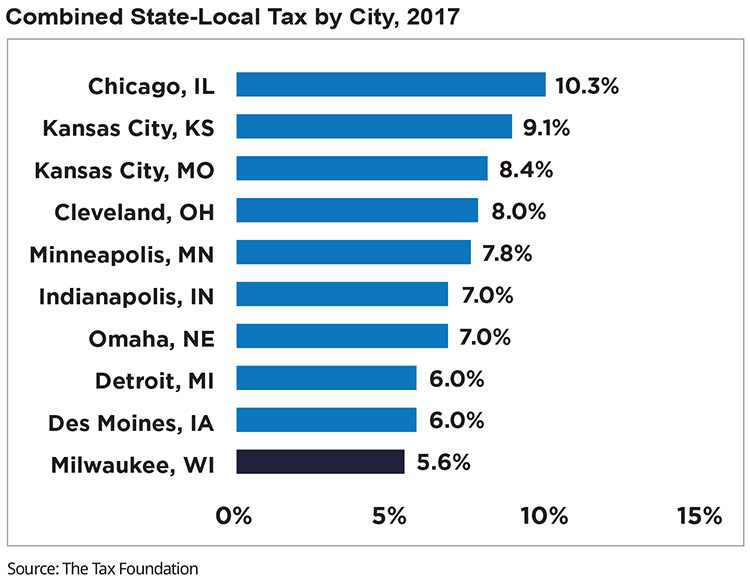

If the sales tax is increased to 6.5 percent, Milwaukee County would still have a relatively low sales tax compared to other major cities like Chicago with 10.25 percent, Minneapolis with 8.03 percent, and Cleveland with 8 percent. Detroit and Des Moines, which have a 6 percent sales tax, would be lower.

In Wisconsin, the state sales tax rate is currently 5 percent. State law authorizes counties to adopt an additional countywide sales tax up to 0.5 percent, and 66 counties have done so. However, municipalities — which include cities, villages and towns — are generally not allowed to impose their own sales tax unless the municipality is considered a “premier resort area.” A premier resort area tax allows specific municipalities that are considered high tourism areas to impose a local sales tax ranging from 0.5 to 1.25 percent to pay for infrastructure expenses within the community. To date, seven municipalities in Wisconsin are considered to be premier resort areas: the village of Sister Bay, the city of Rhinelander, the village of Stockholm, the city of Eagle River, the city of Bayfield, the city of Wisconsin Dells, and the village of Lake Delton. Finally, the legislature authorized Milwaukee County to increase sales taxes by another 0.1 percent to help fund the Miller Park baseball stadium; that tax is set to expire in 2020.

Proposed legislation

The legislation, Assembly Bill 521/Senate Bill 471, authored by Rep. Evan Goyke (D-Milwaukee) and Sen. LaTonya Johnson (D-Milwaukee), would allow Milwaukee County to hold a referendum to increase the county sales tax by 1 penny with 25 percent of the increased sales tax revenues to be allocated toward property tax reduction. Under the bill, the property tax relief would be given only to residential property owners and not commercial owners, and the revenues would be divided evenly between county and municipal property tax relief.

Supporters of the bill maintain that the legislation would reduce the property taxes in Milwaukee County on the median home by more than 10 percent, with actual property tax reductions varying between 4 and 11 percent, depending on where within the municipality the residence was located.

With respect to the remaining revenues generated that are not allocated to property tax relief, 7 percent must be used for public health infrastructure projects, and the remaining funds — which is 68 percent of the total new tax revenues — must be divided evenly between Milwaukee County and the municipalities within the county for local needs such as public safety, parks, capital improvements, lead abatement or other countywide priorities.

The proposed 1 percent sales tax increase would not be added to purchases of essential items like groceries, pharmaceuticals and medical equipment, which are already exempt from the sales tax. The current sales tax in Milwaukee consists of a 5 percent state sales tax, 0.5 percent county sales tax and 0.1 percent Miller Park tax, which is expected to end by 2020.

Increasing the sales tax by 1 penny would raise the Milwaukee County sales tax to 6.6 percent for purchases in the county. Supporters estimate that about 25 percent of the sales taxes generated would be paid by tourists and non-Milwaukee residents buying things in the county.

The estimated revenue from the sales tax increase is $160 million in the first year.

WRA position

The WRA, which has long advocated for a different, less-property-tax heavy funding mix for local government services, is currently reviewing the proposal to determine the impacts on homeowners and the real estate industry. Based upon a preliminary review of the legislation, the following concerns have been identified:

-

Property tax relief: The proposal requires 25 percent of the increased revenue to lower the property taxes of residential property taxpayers. Some feel that 25 percent is too low and a higher percentage of the additional revenue should be allocated toward property tax relief. Given that Wisconsin has some of the highest property taxes in the country, meaningful property tax relief should be a bigger priority in the legislation.

-

Commercial property taxes: The proposal focuses on property tax relief for residential property owners but not commercial. Some feel this is a violation, at least in spirit, of the state constitution’s uniformity clause, which requires all real property to be taxed uniformly. Note: Legal experts maintain this is not a legal violation of the uniformity clause because the proposal continues to tax all property in the same manner, but simply allocates a portion of the additional sales tax revenue generated to buying down residential property taxes.

-

Local referendum: While the proposal allocates some of the additional revenues to lowering property taxes, the proposal does nothing to limit the ability of Milwaukee County to increase property taxes through referendum, and thus does not guarantee that property taxes will be lower.

Like most reforms, this proposal will likely be controversial, with opponents raising concerns about the overall spending increases allowed for under the bill without any guarantees for property tax relief. Supporters will counter that the cost of providing local services will continue to increase and doing nothing will only result in greater pressure on the property tax.

Regardless of your perspective, the bill authors should be applauded for proposing a creative solution to help local government fund the growing costs of providing local services and infrastructure without increasing property taxes.

Wisconsin ranks seventh in the nation and first in the Midwest for its reliance on property taxes for funding municipalities.

Tom Larson is Senior Vice President of Legal and Public Affairs for the WRA.