In the course of updating the WB-11 Residential Offer to Purchase, the WRA Forms Committee and the Real Estate Contractual Forms Advisory Committee at the Department of Safety and Professional Services (DSPS) decided some of the provisions in the 2011 WB-11 needed some clarification and freshening up, to the end of making various provisions more understandable and easier to use. Some of the provisions that were revised in the 2020 WB-11 include the Earnest Money provisions, the Inspection Contingency, the Financing Commitment Contingency, the Seller Financing provision, the provision for Offers Not Contingent Upon Financing, the Appraisal Contingency, the Closing of Buyer’s Property Contingency, the Bump Clause, the Distribution of Information provision, and the Property Damage Between Acceptance and Closing provision. Here are some highlights regarding those revisions.

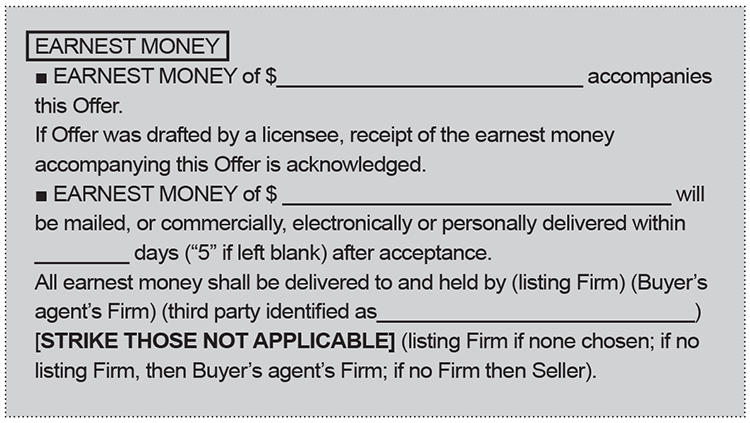

Earnest money

When it comes to a party paying earnest money, the revised language in the Earnest Money provisions on page 2 of the 2020 WB-11 will allow the buyer to deliver the earnest money electronically if the buyer prefers, instead of mailing the earnest money, having it commercially delivered or personally delivering the funds.

In recognition of the practice in some markets of having a title company hold the earnest money instead of a real estate firm, the language was modified with regard to whom the buyer will deliver the earnest money and who will hold it. A STRIKE THOSE NOT APPLICABLE feature allows the parties to designate if the earnest money will be delivered to and held by the listing firm, the buyer’s agent’s firm, or a third person named on a blank line. That might be a title company. For those who do not complete the STRIKE THOSE NOT APPLICABLE provision, the default is, first of all, the listing firm. If there is no listing firm in the transaction, then it will be the buyer’s agent firm. If there are no firms in the transaction, then the seller receives and holds the earnest money. The parties are urged to have an escrow agreement drafted if someone other than a firm holds the earnest money because the offer provisions for disbursement of earnest money apply only to disbursements by a real estate firm.

All of the earnest money provisions, including those for earnest money disbursement by a firm, appear together on page 2. In the disbursement section, the list of ways a firm might obtain authorization to disburse now include a reference to an authorization granted in the contract, bringing the contract provision into conformance with the list of safe harbor disbursement authorizations found in Wis. Admin. Code § REEB 18.09.

Inspection contingency

The Inspection Contingency, now appearing on page 4 of the 2020 WB-11, may look a bit different because it has been formatted differently, with lists of numbered or lettered items pulled to the left margin to facilitate conversation about the various choices a party has and the various consequences to a particular action. The contingency is presented as a list of three numbered inspections: (1) the home inspection, (2) separate inspections of any specific property components, such as the roof or the foundation, identified in the blank line provided, and (3) follow-up inspections recommended in the home inspection or a component inspection report.

A note has been added that provides the definition of “Defect” in the part of the Inspection Contingency discussing a Notice of Defects. No more turning pages or scrolling to find the definition in the middle of a discussion of inspection contingency alternatives

Finally, with regard to time frames, there is a blank line for specifying the deadline for the Inspection Contingency as before, but there is also a default of 15 days stated. This is a theme throughout the 2020 WB-11: defaults have been added for most blank lines as well as STRIKE ONE features to guard against occasional oversights. For the time frame in which the seller must respond if a notice of defects is delivered, there is now a blank line with a default of 10 days, instead of 10 days printed in the provision as is the case in the 2011 offer. Thus, a different time frame may be inserted if desired, but it will remain at 10 days if nothing is written in.

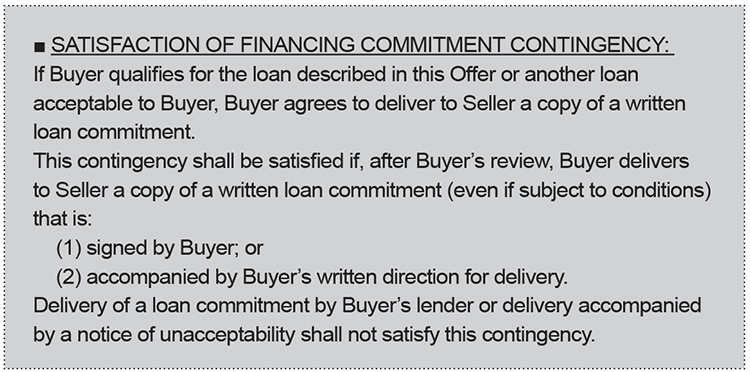

Financing commitment contingency

The Financing Contingency is on page 5 of the 2020 WB-11 and has been renamed the “Financing Commitment Contingency.” The provision that indicates the buyer agrees to pay discount points in an amount not to exceed __% now has a default for that blank line of “0.” The buyer agrees to pay all customary loan and closing costs, wire fees and loan origination fees, to promptly apply for a mortgage loan, and to provide evidence of application promptly upon request. A new provision states the seller agrees to allow the lender’s appraiser access to the property to clear up the confusion that sometimes arises over appraiser access. The provision whereby the amounts describing the terms of the desired loan commitment automatically adjust if the purchase price changes are now in a separate subsection called Loan Amount Adjustment.

If the loan is to have an adjustable interest rate, part of the language has been rewritten with regard to potential interest rate increases, as follows: “the interest rate may be increased not more than ________% (“2” if left blank) at the first adjustment and by not more than ________% (“1” if left blank) at each subsequent adjustment. The maximum interest rate during the mortgage term shall not exceed the initial interest rate plus ________% (“6” if left blank).” These defaults were included based on the predominant financing available in the market and were provided because too often these blanks are not filled in at all, making it difficult to know if a loan commitment fulfills the contingency.

Instead of a Buyer’s Loan Commitment subsection, there is now a subsection labeled Satisfaction of Financing Commitment Contingency, which not surprisingly tells the buyer how to satisfy the contingency. The buyer is to deliver a copy of the loan commitment the buyer qualifies for. The delivery must be authorized; it’s authorized if the loan commitment is signed by the buyer, or it can be authorized if the buyer gives separate written directions for delivery that accompany the loan commitment, as is the case in the 2011 WB-11. Delivery of a loan commitment by a lender or accompanied by a notice of unacceptability does not satisfy the contingency.

The caution following this provision states:

“The delivered loan commitment may contain conditions Buyer must yet satisfy to obligate the lender to provide the loan. Buyer understands delivery of a loan commitment removes the Financing Commitment Contingency from the Offer and shifts the risk to Buyer if the loan is not funded.”

This is an important aid when explaining to the buyer what it means when a loan commitment is delivered.

The language of the Seller Termination subsection was rewritten to be clearer, but the provision operates as before. The Financing Commitment Unavailability language has been split apart from Seller Financing, which is now a separate optional provision.

Seller financing provision

If the offer is to include the option for seller financing, the check box at line 289 at the top of page 6 will need to be checked. If this Seller Financing provision is included in the offer, the seller has 10 days after the buyer’s delivery of evidence of unavailability or the deadline for delivery of the loan commitment, whichever comes first, to deliver written notice to the buyer informing the buyer the seller will provide financing. A seller decision to not provide seller financing does not terminate the offer.

Offer not contingent upon financing

If the box on line 249 is not checked to include the Financing Commitment Contingency, then the page 6 provision, If This Offer Is Not Contingent Upon Financing Commitment, automatically applies. First of all, there is a change regarding the time frame: the 2011 WB-11 says the buyer must deliver documentation to the seller within seven days of acceptance, while the 2020 offer provides a blank line to be filled for the time frame with a default of seven days. The documentation to be delivered may be reasonable written verification from a financial institution or third party in control of the buyer’s funds that indicates the buyer has, at the time of verification, sufficient funds to close, as is the case in the 2011 offer.

But there is a second choice: the parties may write in whatever documentation they agree the buyer should deliver to the seller, presumably to show the seller the buyer has the financial means to buy the property. If something is written in the blank lines, the buyer may choose whether to deliver the reasonable third-party written verification or the documentation described in the blank lines. If nothing is written in, the provision will operate as before with the seller entitled to receive reasonable third-party verification of funds.

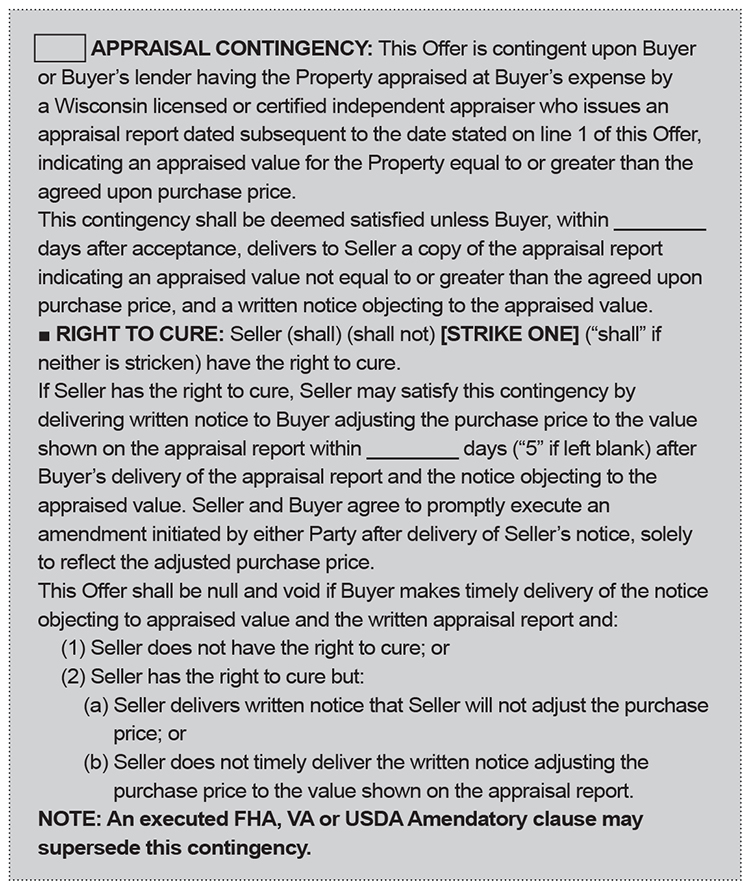

Appraisal contingency

The Appraisal Contingency on page 6 of the 2020 offer now has a right to cure. If the buyer is dissatisfied with the appraised value, the buyer can deliver a copy of the appraisal report along with a notice objecting to the appraised value. By way of contrast, in the 2011 offer, the buyer delivered the appraisal report plus a notice of termination. The 2020 WB-11 has a STRIKE ONE feature for indicating whether the seller does or does not have the right to cure. If so, the seller may deliver a written notice to the buyer adjusting the purchase price to match the appraised value. The time frame for this is a blank line with a default of five days after delivery of the buyer’s notice of objection. The parties also agree to promptly execute an amendment to the offer, if initiated by either party, to change the purchase price.

If the seller does not have a right to cure or does not deliver notice adjusting the purchase price, the offer is null and void. This right-to-cure provision doesn’t take away the option for the parties to instead agree to an amendment naming a compromise price or some other solution, as would be the case in the 2011 offer.

Closing of buyer’s property contingency

For those rare cases when the deadline for the closing of the sale of buyer’s property is not the same as the closing date, changes have been made in the Closing of Buyer’s Property Contingency on page 6 of the 2020 WB-11 to indicate the consequences if the transaction for the sale of the buyer’s property does not close by the stated deadline. Specifically, the offer becomes null and void if the deadline passes without a closing unless the buyer delivers to the seller, on or before the deadline, reasonable written verification that the buyer has the funds to close from a financial institution or third party in control of the buyer’s funds.

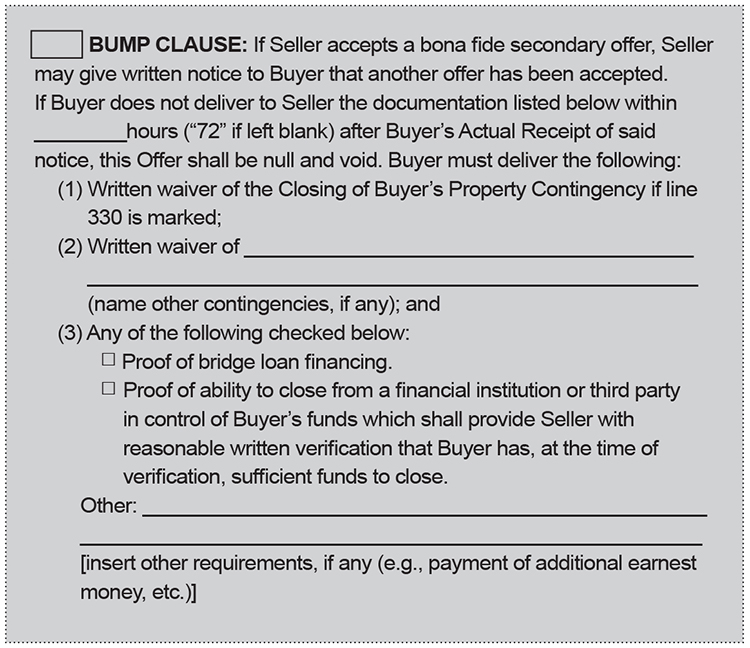

Bump clause

The bump clause is now a separate check box item in the 2020 WB-11 and has that “spread out” formatting to enhance user understanding. The most important change in the bump clause, appearing on the bottom of page 6 directly after the Closing of Buyer’s Property Contingency, is the default of 72 hours for the blank line where the bump clause time frame is to be entered. This is one of the most frequent errors recounted to the WRA Legal Hotline, and finally it will stop!

In terms of what must be delivered to the seller by a buyer receiving a bump notice, the provision gives a list:

- First, a written waiver of the Closing of Buyer’s Property Contingency must be delivered to the seller if the box on line 330 has been checked, making that contingency a part of the offer.

- Second comes the opportunity to make other provisions in the offer subject to the bump clause. A waiver of any contingencies written in the blank line provided must also be delivered. If nothing is written in, then the second item can be disregarded.

- Third, the buyer must deliver any other documentation indicated: there are check boxes for a bridge loan and for third-party reasonable written verification of funds, and other requirements may be written in on the blank line where it says “Other.” Thus, a laundry list of the documentation a buyer must deliver to satisfy the bump is put together.

If the parties only want a waiver of the Closing of Buyer’s Property Contingency to be delivered, as is the case in the 2011 offer if nothing additional is written in, all that needs to be done in the 2020 offer, assuming the Closing of Buyer’s Property Contingency has been checked and filled out, is to check the box for the bump clause.

Distribution of information

The Distribution of Information provision at the bottom of page 8 of the 2020 WB-11 has an addition to the language. The buyer and the seller authorize their agents to “(iv) distribute copies of this Offer to the seller, or seller’s agent, of another property which Seller intends on purchasing.” If the seller is purchasing a new property, this language enables the seller to provide a copy of the offer to the sellers of the property the seller intends to buy should that be required in the offer. This provision does not authorize licensees to provide copies of offers to other buyers in a price escalation or acceleration scenario.

Property damage between acceptance and closing

First, a portion of what had been in the Property Damage Between Acceptance and Closing provision in the 2011 offer has been split off to create the Maintenance provision appearing at the top of page 9 in the 2020 WB-11. This separate Maintenance provision states:

“Seller shall maintain the Property and all personal property included in the purchase price until the earlier of closing or Buyer’s occupancy, in materially the same condition as of the date of acceptance of this Offer, except for ordinary wear and tear."

This is immediately followed by the Property Damage Between Acceptance and Closing provision, which includes new obligations for the seller: if the property is damaged in an amount not more than 5 percent of the purchase price, the seller must promptly notify the buyer, in writing, and must restore the property. In addition, the seller shall provide the buyer with copies of all required permits and lien waivers. As it turns out, the seller is obligated to notify the buyer of property damage occurring after acceptance of the offer and before closing regardless of whether the amount of the damage exceeds, is equal to, or is more than five percent of the purchase price.

Resources

The 2020 WB-11 Residential Offer to Purchase is available in a copy watermarked “educational use only” on the DSPS website at dsps.wi.gov/Documents/BoardCouncils/REB/Forms/WB11FINALwatermarked.pdf and will be available in a clean, unmarked version on the DSPS website on November 1, 2019. It also will be available from the WRA on zipForm and in the WRA PDF forms library. The WRA will not produce printed copies.

WRA resources

Look for several future WRA LegalTalks videos, Legal Update publications, a new WB-11 episode in the Line by Line video series, and other educational materials coming your way soon. Visit the forms update resource page online at www.wra.org/formsupdate to see the resources currently available.

The discussion continues

This three-part article continues with the second part of the discussion, which explores clarification revisions made to the WB-11.

See part 3 of this article here.

See all three parts of the article on the following webpages: