Every time there is an updated real estate form, you have to expect there will be something brand new, such as some new provisions that were not in the form before. The updated 2020 WB-11 Residential Offer to Purchase does not disappoint on that score! Read on to find out about the new provisions you’ll see in the updated WB-11 form.

Homeowner association provision

First, there is a new provision regarding homeowner associations. The new provision, found near the top of page 7 of the 2020 WB-11, advises the parties that if the property is subject to a homeowner association, the property may be subject to periodic fees and a fee upon the transfer of the property. The parties may use the included STRIKE ONE feature to indicate whether any transfer fee will be paid by the buyer or by the seller. The default is the buyer in case this provision is overlooked.

Radon testing contingency

Because many offers are drafted incorrectly with radon testing written into the Inspection Contingency, where it clearly does not belong, and because some home inspectors conduct radon testing without any contract authority whatsoever, it was decided it was best to include a radon testing contingency in the updated offer so details about radon testing may be included in the contract if testing will be done.

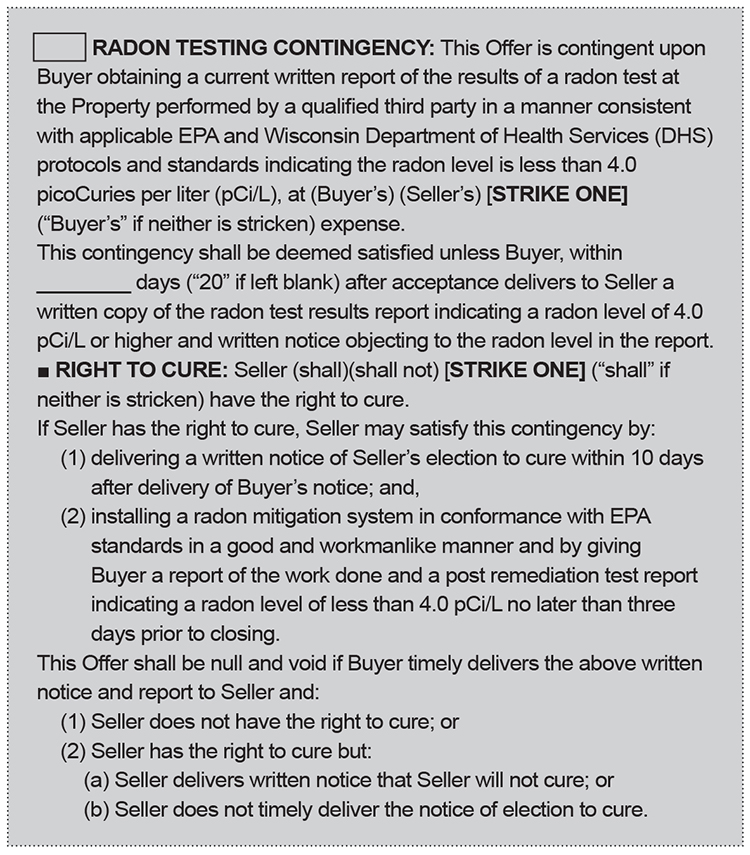

The Radon Testing Contingency on the top of page 5 of the 2020 WB-11 calls for the buyer to arrange for radon testing to be performed by a qualified third party in a manner consistent with applicable U.S. Environmental Protection Agency and Wisconsin Department of Health Services protocols and standards. The test results must show the radon level is less than 4.0 picoCuries per liter (pCi/L) to satisfy the contingency. There is a STRIKE ONE feature indicating who pays for the testing, with the buyer named as the default.

The contingency is deemed satisfied unless the buyer delivers a copy of the test results showing a radon level of 4.0 pCi/L or higher and a notice objecting thereto. The buyer’s deadline for objecting is expressed as “____ days (“20” if left blank) after acceptance.” Once again, a default is provided for those “oops” moments.

The Radon Testing Contingency includes the ability to choose whether the seller has a right to cure in a provision structured similarly to the Right to Cure subsection in the Inspection Contingency. A seller has 10 days to deliver written notice electing to cure. If the seller elects to cure, the seller must install a radon mitigation system in conformance with EPA standards in a good and workmanlike manner and give the buyer a report of the work done and a post-remediation test report indicating a radon level of less than 4.0 pCi/L no later than three days before closing. The offer shall be null and void if any of these scenarios occur: the buyer’s notice is delivered and the seller does not have the right to cure, the seller delivers notice electing not to cure, or the seller allows the 10 days after delivery of the buyer’s notice to expire.

Firms and their licensees will still have the ability to use a different version of a radon testing contingency in their addenda since it is an optional, check box provision.

FIRPTA provision

According to 2015 U.S. Census figures, approximately 5 percent of Wisconsin’s population was foreign born. While this percentage may not seem like a lot, it certainly does raise the possibility of encountering real estate transactions in which the seller is a “foreign person.” That fact can have significant consequences for the buyers, sellers and agents in the transaction.

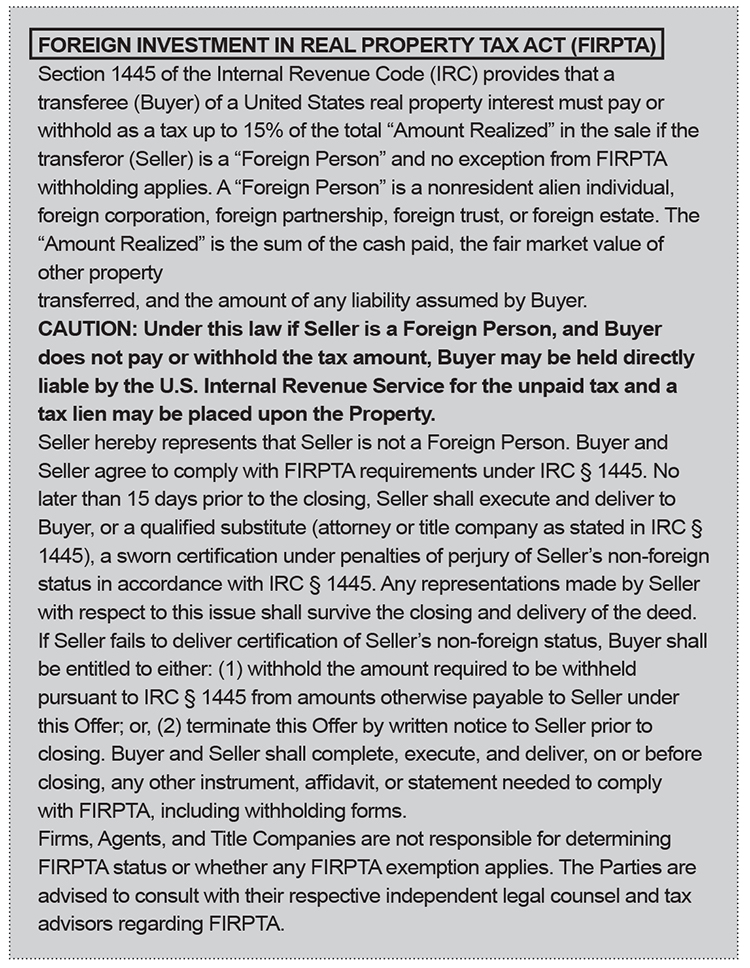

Buyers purchasing a property from a person classified as a “foreign person” are subject to the federal tax law provisions of the Foreign Investment in Real Property Tax Act (FIRPTA). Although these transactions are infrequent, there can be significant adverse consequences for buyers who do not comply with FIRPTA, and there have been incidences where the blame — and the penalties — for noncompliant buyers was shifted to real estate agents, primarily because the agents did not alert the buyer to FIRPTA. Accordingly, Wisconsin is following the example set by several other states, including Minnesota, in including a FIRPTA provision in the 2020 version of the offer on pages 9-10 of the offer.

FIRPTA is tax law. FIRPTA is about the Internal Revenue Service (IRS) taxing foreign persons selling United States real estate. The IRS is concerned that foreign persons will sell their property and leave the country without paying the tax due on the sale. The IRS solution is to make the buyer responsible for making sure the tax is collected because the buyer will still be here, and the buyer has an identifiable asset that can be attached with a lien if need be, that is, the property.

FIRPTA, as stated in § 1445 of the Internal Revenue Code (IRC), provides a buyer must pay or withhold as a tax up to 15 percent of the total amount realized in the sale if the seller is a “foreign person,” and no exception from FIRPTA withholding applies. A “foreign person” is a nonresident alien individual, foreign corporation that has not elected to be treated as a domestic corporation, foreign partnership, foreign trust or foreign estate. It does not include a resident alien individual. U.S. green card holders, U.S. citizens and non-citizens who fulfill the requirement of the substantial presence test are not subject to FIRPTA.

How does one know if a seller is a foreign person? There is a bill before the legislature to add the question of whether an owner is a foreign person to the Real Estate Condition Report and the Vacant Land Disclosure Report; and the WRA Listing Questionnaire Regarding Title Issues and Property Conditions, available on zipForm, includes this question.

What are the significant adverse consequences for buyers? If the seller is a foreign person, and the buyer does not pay or withhold the tax amount, the IRS may hold the buyer liable for the unpaid tax, and a tax lien may be placed upon the property to secure payment.

How about those exceptions? One exception is for the seller to provide a sworn certification under penalties of perjury regarding his, her or its non-foreign status in accordance with IRC § 1445. The provision in the offer presumes the seller is not a foreign person and provides for the seller to execute and deliver the certification no later than 15 days prior to closing. If the seller is a foreign person, the parties should confer with legal and tax counsel and modify the offer if they wish to go forward.

The offer indicates the certification is to be delivered to the buyer or a qualified substitute. The IRC definition of a qualified substitute includes the attorney or title company responsible for closing the transaction. Delivery to the title company is the preferred resolution from a licensee’s perspective because the certification includes the seller’s tax identification number: the certification goes from the seller to the title company without licensees having to hold or transmit it and without using the parties’ contact information. The qualified substitute is to deliver a statement to the buyer advising that the title company has the seller’s certification.

For those concerned about security during email transmission of the certification, one solution may be to have the seller mail the certification to the title company. If the title company is unhappy with this, possibly a mailing address for the buyer may be provided, and the firm might look for a different title company for the next transaction.

A certification form will be available in the WRA’s zipForm as well as in the WRA PDF forms library online. The executed certification is the golden ticket, the buyer’s insurance policy indicating the buyer will not be on the hook to the IRS for a foreign seller’s unpaid tax.

Under the FIRPTA provision on pages 9-10 of the updated WB-11, if the seller fails to deliver the certification of non-foreign status, the buyer may withhold the amount required per IRC § 1445 from amounts otherwise payable to the seller at closing or terminate the offer by written notice to the seller prior to closing. The buyer also might propose to amend the offer with another approach upon the advice of legal or tax counsel.

Are there other FIRPTA exceptions? Yes, there are, but those are for the parties’ tax advisers and attorneys to interpret and apply to the particular situation.

The end of the FIRPTA provision in the offer states, “Firms, Agents, and Title Companies are not responsible for determining FIRPTA status or whether any FIRPTA exemption applies. The Parties are advised to consult with their respective independent legal counsel and tax advisors regarding FIRPTA.”

Resources

2020 WB-11 Residential Offer to Purchase Form

The 2020 WB-11 Residential Offer to Purchase is available in a copy watermarked “educational use only” on the DSPS website at dsps.wi.gov/Documents/BoardCouncils/REB/Forms/WB11FINALwatermarked.pdf and will be available in a clean, unmarked version on the DSPS website on November 1, 2019. It also will be available from the WRA on zipForm and in the WRA PDF forms library. The WRA will not produce printed copies.

WRA resources

Look for several future WRA LegalTalks videos, Legal Update publications, a new WB-11 episode in the Line by Line video series, and other educational materials coming your way soon. Visit the forms update resource page online at www.wra.org/formsupdate to see the resources currently available.

The discussion continues

This three-part article explores clarification revisions made to the WB-11.

See all three parts of the article on the following webpages: